Key Takeaways

- US economic growth remains resilient and a recession seems unlikely in the near-term, although geopolitical concerns and pockets of weakness within the retail and manufacturing sectors suggest areas of softness are emerging.

- The equity market broadened in the recent quarter, with small and mid-cap company stocks outperforming their large-cap brethren.

- The Federal Reserve’s rate-cutting cycle got off to a strong start with a 50 basis point reduction in September and the prospect of additional cuts to come later this year and throughout 2025.

Total Returns and Values as of 9/30/24

| QTD Return | YTD Return | Price/Value | |

|---|---|---|---|

| Dow Jones Industrial Average | 8.7% | 13.9% | 42,330 |

| S&P 500 Index | 5.9% | 22.1% | 5,762 |

| Equal-Weighted S&P 500 Index | 9.6% | 15.2% | 7,269 |

| Bloomberg US 2000 | 9.8% | 10.2% | 1,535 |

| MSCI EAFE Index | 7.3% | 13.5% | 2,469 |

| MSCI EM (Emerging Markets) | 8.9% | 17.2% | 1,171 |

| Bloomberg US Aggregate | 5.2% | 4.4% | 94 |

| Bloomberg Municipal Bond | 2.7% | 2.3% | 104 |

| Gold (NYM $/ozt) Continuous | 13.7% | 28.4% | $2,659.40 |

| Crude Oil WTI (NYM $/bbl) Continuous | -16.4% | -4.9% | $68.17 |

There is no guarantee that forecasts or estimates discussed herein will materialize, or that trends discussed herein will continue.

Economic Review

With interest rates starting to come down against a backdrop of declining inflation, our outlook for US economic growth over the next 6 to 12 months is one of cautious optimism. Our view is tempered by several critical factors, primarily regarding the health of the US consumer, the driver of the majority of economic activity in this country. Reasonable levels of consumer spending and confidence, along with a healthy labor market, will go a long way towards the Fed achieving a soft landing whereby inflation remains controlled without the economy tilting into recession.

Declining Inflation Yet Elevated Prices

The decline in inflation to 2.5%, which is well within range of the Fed’s 2% target, is a positive sign, indicating that the Fed’s measures to combat inflation are having the desired effect. This should help stabilize consumer purchasing power and confidence. However, while the price increases of durable goods have moderated significantly, inflation in other areas, particularly housing, remains more persistent.

Inflation has affected both consumers and businesses, weakening consumer demand and delaying investments and inventory replenishments. It is important to note that declining inflation refers to a reduction in the rate at which prices increase, not an overall decrease in prices. Consumers still feel the financial strain because the price level of goods and services today is much higher compared to previous years.

The Fed’s September Rate Cut

The Fed’s recent cut of the fed funds rate aims to stimulate the economy by reducing borrowing costs, which helps to alleviate financial pressure on consumers and businesses. The Fed’s decision to cut rates by 50 basis points, a more aggressive move than the anticipated 25 basis points (one basis point is equal to 1/100th of a percent), is an effort to stay ahead of any potential economic slowdown.

This first cut to the fed funds rate since March 2020, brought rates down to a range of 4.75% to 5.00%, from the 5.25% to 5.50% level that existed since last July, the highest since 2001. As long as inflation appears to be under control, we expect the Fed to proceed with implementing a series of rate cuts through the remainder of 2024 and into 2025. The expectation is for additional 25 basis points reductions at each of the upcoming November and December meetings. The Fed’s most recent “dot plot” of expected rates indicates a fed funds target of 3.375% by the end of 2025.

Fed Chairman Jerome Powell has noted that the economy is in good shape, and the aggressive 50 basis point move is to allow for solid growth and a steady labor market, with inflation trending lower. “We’re trying to achieve a situation where we restore price stability without the kind of painful increase in unemployment that has come sometimes with disinflation,” he said in the recent post-meeting press conference. Powell added that investors should take the 50 basis point rate cut as a sign of the Fed’s “strong commitment” toward achieving that goal.

A Word About US National Debt & Fiscal Policy

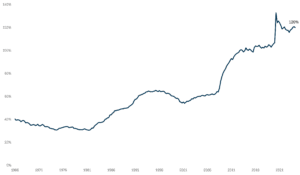

The US federal debt as a percentage of gross domestic product is at 120%, an all-time high, and rising debt service costs are a concern. The national debt now surpasses $35 trillion and the federal government has paid over $1 trillion in gross interest payments on its debt for fiscal 2024. For the first time, the US is spending more on debt interest than defense.

US Federal Debt as Percent of Gross Domestic Product

(1/1/66 – 4/1/24)

Source: Federal Reserve Bank of St. Louis

The significant amount of the national debt could limit the government’s future ability to stimulate the economy through additional spending measures, as it did during the Covid epidemic and the financial crisis of 2007 to 2009. Additionally, in the run up to the November election, both political parties are making promises that could increase spending and overall debt levels. Excessive spending and debt accumulation have long-term economic consequences, as would a shift in global market sentiment regarding the value and perceived safety of US Treasuries.

Consumer Spending & Behavior

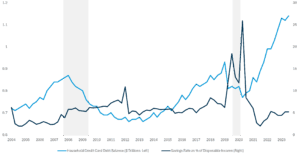

Consumer willingness to spend is a prime driver of US economic growth. In the past several years, labor market strength, including solid wage growth, combined with a post-pandemic sentiment of having lost time during Covid-19, has contributed to a healthy appetite for consumer spending. However, there are signs of financial strain in the amount of consumer debt accumulated, particularly for consumers at lower income levels.

While the inflation rate is declining, the cumulative effects of past inflation continue to affect consumer sentiment and spending patterns. There is evidence of consumers trading down to lower-cost alternatives, such as generic store brands, which is helping to moderate inflation in certain sectors. Credit card debt has spiked, indicating that consumers are relying more on credit to manage expenses, with US consumer credit card debt recently surpassing $1 trillion. Declining interest rates may provide some relief for consumers with credit card balances.

Household Credit Card Debt Balance (Trillions) vs. Savings Rate (% of Disposable Income)

(12/31/04 – 6/28/24)

Source: New York Fed, Factset

A decline in interest rates means mortgage rates also move lower, which traditionally has stimulated demand in the housing sector, adding to economic growth. With current rates in the 6% range, and the average rate on an outstanding mortgage below 4%, it likely will take several more rate cuts before potential sellers would be willing to give up their current mortgages, many of which are long-term, fixed-rate loans. At the same time, buyers may delay purchasing homes in anticipation of further rate cuts.

Employment & Wage Growth

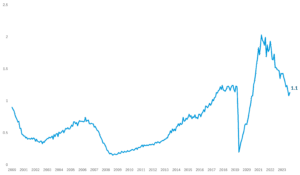

The labor market is another critical factor for economic growth. The Fed can shift its attention, which has focused on tempering inflation, to the labor market. Current employment trends indicate a softening labor market, with a ratio of job openings on par with job seekers. This ratio is notable when compared to post-pandemic levels when there were nearly two job openings for every job seeker. Companies are not hiring across the board, but instead are focusing on retaining current employees and improving productivity.

Ratio of US Job Openings to US Job Seekers

(12/1/00 – 8/30/24)

Source: BLS, 1919

The unemployment rate has risen to 4.2%, from a low of 3.4% in 2023. Likewise, quit rates have dropped to about 2%, aligning with 30-year averages, while wage growth is expected to moderate. A declining quit rate indicates employees are less confident that it will be easy to find a new job after quitting an existing one, a sign of a less tight labor market. The Fed will monitor unemployment closely, as a higher trend would support more policy accommodation. We expect the labor market to stabilize in 2025 as wages are still rising at a 4% rate, suggesting demand for labor remains healthy.

US Election Considerations & Geopolitical Risks

The upcoming US election introduces uncertainty regarding future economic policies and market reactions to the results. Markets generally prefer a divided government, and we believe a sweep by either party is not fully priced into current valuations. Specific considerations on our radar include:

- Potential changes in fiscal policy, including tax cuts or increased spending, exacerbating current high deficit and debt levels. A material increase in corporate tax rates would reduce earnings

and add a headwind to equities. - Potential changes in economic policies, such as significant tariff increases or hostility towards international institutions like NATO, could have economic repercussions. If costs are passed along to consumers, such tariffs can act as a tax.

- Testing of new US government leadership by adversaries would increase geopolitical tensions.

- Current high valuations leave little room for error, making the market vulnerable to corrections influenced by a reaction to election outcomes, political changes or headline risks.

In addition, ongoing conflicts in Ukraine and the Middle East continue to pose risks and could have broader implications for global stability and economic conditions. Rising tensions in the Middle East, in particular, affect global oil prices. All of these risks could spark market volatility and negatively impact economic growth.

Our Outlook for US Economic Growth

We expect growth to slow as we near year-end 2024 and enter 2025. While declining inflation and the Fed’s accommodative stance support growth, uncertainties in consumer behavior, business investment, and geopolitical risks suggest that growth will moderate into 2025. Slowing economic growth impacts corporate earnings and, in turn, can impair equity market returns.

Equity Market Highlights

Market Broadening

There has been a noticeable broadening of equity market performance in Q3 2024, with small-cap and mid-cap outperforming large-cap stocks and the “Magnificent Seven” no longer leading the charge. The equal-weighted S&P 500 Index rose 9.6% for the quarter, outperforming the market-weighted S&P 500 Index, which was up only 5.9%. This indicates that smaller and mid-sized companies have performed better than the larger, more dominant companies in the index. Interest rate-sensitive sectors, including financial services, real estate, and utilities, performed well due to lower funding costs and attractive dividend yields.

Meanwhile, the hype around AI-related (artificial intelligence) technology stocks has cooled somewhat. While these companies led the equity market earlier, their recent performance has been mixed. The information technology sector has shown modest gains this quarter, but the broader market outperformance suggests that investors are diversifying beyond technology and AI-related stocks. While the significant price appreciation in some of these stocks has paused and valuations must always be respected, we believe the underlying fundamental growth for companies that significantly improve productivity, and the well-being of people in areas such as healthcare and education will persist for many years to come.

Overall, the stock market recently hit several record highs, including the S&P 500 closing at 5,718.57 on September 23 and the Dow Jones Industrial Average closing at 42,063.36 on September 20. However, as we noted earlier, it is important to recognize the potential for an equity market correction in an environment of high valuations and heightened global risks. A correction often is defined by a decline of 10% or more from a recent peak. Keeping a long-term perspective in these instances is critical.

Fixed Income Highlights

Interest Rate Movements

Despite the Fed’s aggressive 50 bps rate cut in September, longer term interest rates such as the 10-year Treasury yield actually rose by quarter end, a movement known as a bear steepener. A bear steepener occurs when long-term interest rates increase faster than short-term rates, widening the gap between the two. This market behavior did not surprise us. Short-term interest rates are directly impacted by Federal Reserve policy, while longer-term interest rates are influenced by investors’ inflation expectations over the life of the bond. Given the Fed cut rates while inflation still remains above the Committee’s target in an economic environment fueled by generous fiscal stimulus funded with deficits, it makes sense that investors holding long duration bonds would want to be compensated for the risks that the Fed commits a policy mistake. Based on historical data, this yield still remains too low and should reside closer to 4%, given 2% inflation and 2% real GDP growth.

Issuance and Demand

More corporate bond issuance than anticipated in the third quarter has been well-received by the bond market, indicating a strong demand for bonds. We expect issuance to taper by October as year-end approaches and election uncertainties loom.

Potential changes in the administration and Congress will impact fiscal policies and market sentiment. As always, ongoing geopolitical tensions, such as in Ukraine and the Middle East, affect fixed-income markets, especially with heightened demand for safe US Treasuries which become even more attractive during times of global conflict. Municipal bond valuations remain “rich,” compared to Treasuries but still are attractive for certain investors seeking tax-free income.

Our Fixed Income Outlook Through Year-End

The Fed pivoted in September, cutting the fed funds rate, the overnight rate banks charge each other for lending, by 50 basis points (0.50%). It was the first rate cut in over four years and signaled a policy shift from one of monetary tightening to an easing stance. The Fed is expected to continue cutting rates, with a potential total of 100 basis points by year-end 2024, as well as several additional cuts in 2025.

Potential impacts on credit market stability resulting from the US election and global conflicts will be critical to watch, especially in risky CCC-rated bonds. While Treasury auctions have gone well so far, indicating continued demand for US debt, any disruption in this area requires close attention.

Closing Thoughts

Heading into the last quarter of the year, there are many dynamics to consider, ranging from the upcoming US election to the Fed rate-cut cycle and significant geopolitical concerns. In addition, US equity prices have climbed to new highs. The risk of a correction in equity prices increases as valuations become more stretched. We expect volatility in the fixed-income arena to continue as the market responds to a declining interest rate environment and the yield curve normalizes.

In transition periods like the one we currently are experiencing, it is always important to maintain a long-term focus on your investment goals rather than making decisions influenced by headlines and short-term market disruptions.

All information herein is as of September 30, 2024 unless otherwise stated. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. Past performance is not a guarantee or indicator of future results. No part of this material may be reproduced in any form, or referred to in any other publication, without the express written permission of 1919 Investment Counsel, LLC (“1919”). This material contains statements of opinion and belief. Any views expressed herein are those of 1919 as of the date indicated, are based on information available to 1919 as of such date, and are subject to change, without notice, based on market and other conditions. There is no guarantee that the trends discussed herein will continue, or that forward-looking statements and forecasts will materialize.

This material has not been reviewed or endorsed by regulatory agencies. Third party information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

1919 Investment Counsel, LLC is a registered investment advisor with the U.S. Securities and Exchange Commission. 1919 Investment Counsel, LLC, a subsidiary of Stifel Financial Corp., is a trademark in the United States. 1919 Investment Counsel, LLC, One South Street, Suite 2500, Baltimore, MD 21202. ©2024, 1919 Investment Counsel, LLC. MM-00001362