Building Your Philanthropic Legacy: Charitable Lead Trust

Is a Charitable Lead Trust (CLT) Right for Me?

If you are charitably-inclined and wish to benefit your family, a CLT may be right for you. The main benefits of a CLT are the potential reduction in gift and estate taxes for the non-charitable beneficiaries and, in the case of a grantor trust, an upfront income tax deduction for the grantor. However, the trust’s income is taxable to either the grantor or the trust.

A CLT Works as Follows:

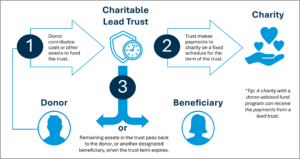

- A CLT is an irrevocable trust that makes payments to one or more charities for a specified term, after which the remaining assets are distributed to non-charitable beneficiaries, such as the grantor’s heirs.

- The grantor transfers cash, securities, or other property to the trust. Depending on the present value of the non-charitable interest, this transfer may be subject to gift tax.

- During the trust term, which can be a set number of years or the lifetime of one or more individuals, the trust pays a fixed annuity or a percentage of the trust assets (unitrust amount) to the designated charity or charities.

- At the end of the term, the remaining assets are distributed to the non-charitable beneficiaries, such as the grantor’s children. While the assets can revert back to the donor at the end of the term, such a result achieves no wealth transfer objective.

Distributions from a Charitable Lead Trust can be made in one of two ways:

- Charitable Lead Annuity Trust (CLAT): The trust pays a fixed dollar amount each year to charity, regardless of the current value of the trust assets. This fixed annuity allows for potential growth in the trust principal as the annuity payments remain constant. As with a Grantor Retained Annuity Trust (GRAT), a CLAT can be “zeroed-out,” meaning that the present value of the gifted amount going to non-charitable beneficiaries can be reduced to zero, triggering no gift tax.

- Charitable Lead Unitrust (CLUT): The trust pays a percentage of the trust assets to charity each year. If the trust’s value increases over time, the amount paid to charity will also increase proportionally. Unlike a CLAT, a CLUT cannot be “zeroed-out.”

Selecting the Right CLT…

Both types of Charitable Lead Trusts provide an income stream to the designated charities for the term of the trust, which is typically a set number of years or the lifetime of one or more individuals. After the trust term ends, the remaining assets are distributed to the non-charitable beneficiaries, such as the grantor’s children or grandchildren.

The choice between an annuity trust or unitrust structure depends on the grantor’s goals and the expected performance of the trust assets. Annuity trusts provide more certainty in the charitable payouts, while unitrusts allow the charity to benefit from potential growth in the trust. CLATs have the added benefit that the taxable gift can be zeroed-out. Another difference is that at the inception of the trust, the donor’s Generation-Skipping Transfer (GST) tax exemption can be allocated to a CLUT, but not to a CLAT. In the case of a CLAT, the GST exemption must be allocated at termination of the trust.

This difference allows the donor to leverage his/her GST exemption when setting up a CLUT based on the actuarial (rather than the actual) value of the remainder.

Unlike a Charitable Remainder Trust, a CLT is a taxable trust. CLTs can be structured either as a grantor trust or non-grantor trust for income tax purposes. If it is a grantor trust, the grantor is treated as the owner of the assets for tax purposes and can claim an immediate income tax deduction for the present value of the charitable payments, subject to certain AGI limitations. In that case, all future income of the trust is taxable to the grantor. If the CLT is a non-grantor trust, the trust pays the taxes and receives charitable tax deductions annually. Because a CLT is a taxable trust, funding it with highly appreciated property is not tax-efficient. However, a CLT can be created at death and the property used to fund the trust can benefit from a stepped-up basis, thus reducing future taxes.

The CLT is a sophisticated gift planning vehicle, and as with all such vehicles, professional counsel should be retained to fully analyze the effectiveness of a particular vehicle given a particular set of circumstances.

Read pdf here.