Investment Review & Outlook – July 2020

- The COVID-19 pandemic continues to negatively impact the health and economic well-being of Americans and the global community. The pressures and challenges as a result of the shutdown have been devastating to millions of unemployed workers and an increasing number of failing businesses.

- We expect a “square root” recovery—an economic bounce-back followed by a prolonged plateau period due to high unemployment and lower demand. A safe and effective vaccine will be a game changer for the US and the world economy, but we do not foresee a high probability of this happening before year-end.

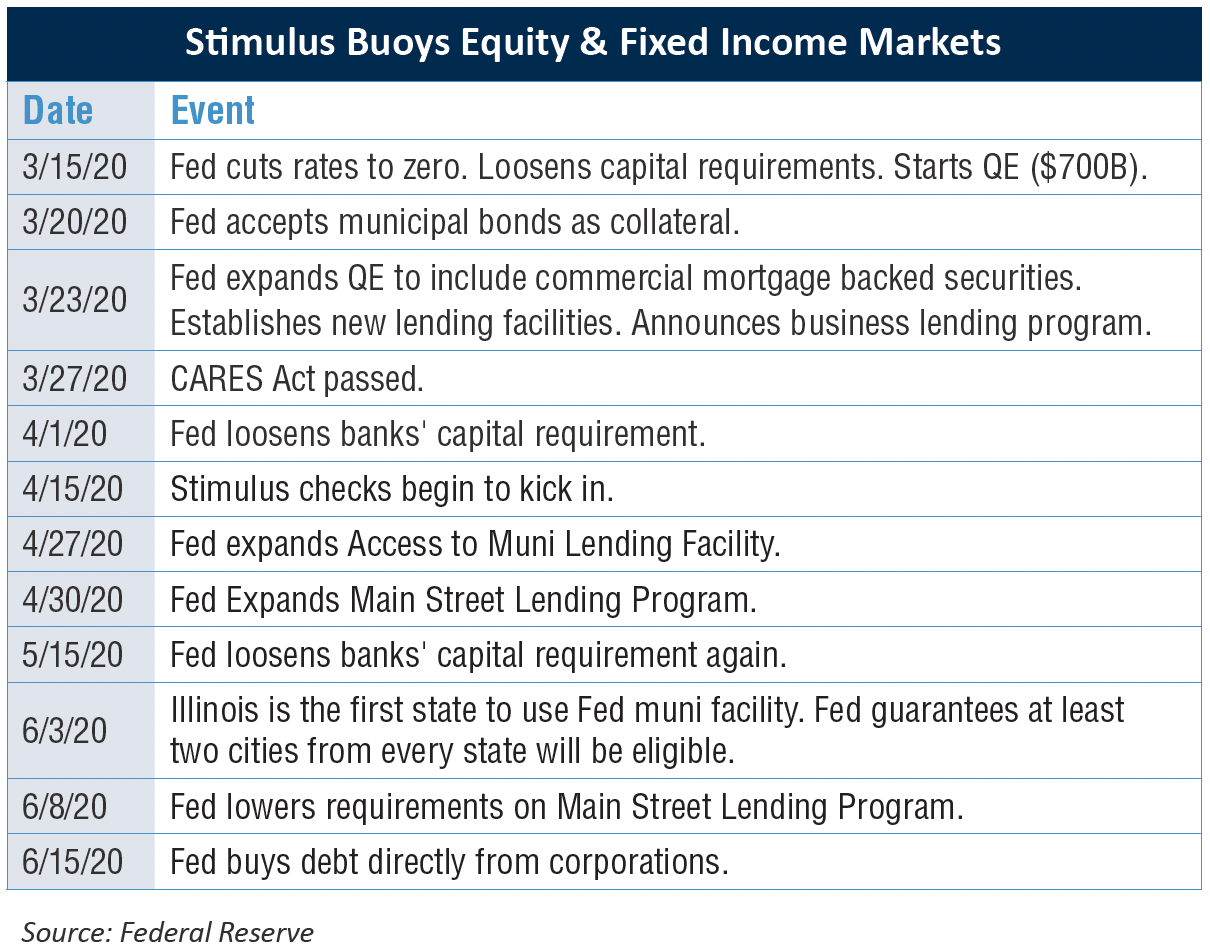

- Despite the turmoil, the liquidity provided by the Federal Reserve as well as fiscal stimulus from Congress have buoyed both the equity and fixed income markets during this unprecedented time.

KEY TAKEAWAYS

- The goal of the Fed and Congress (with the CARES Act) has been to mitigate the immediate financial impact of COVID-19, viewing it as a challenging short-term episode rather than a multi-year or decade-long event. However, inflation, as a result of massive stimulus actions, does not appear to be a concern in the near term, as the economic downturn resulting from the pandemic increases deflationary pressure.

- Confidence continues to be key in the consumer-driven US economy which experienced an unprecedented demand shock due to the economic shutdown and a resultant rapid rise in unemployment. Despite a sharp decline early in the quarter, the levels for May remained stable and then rose in June.

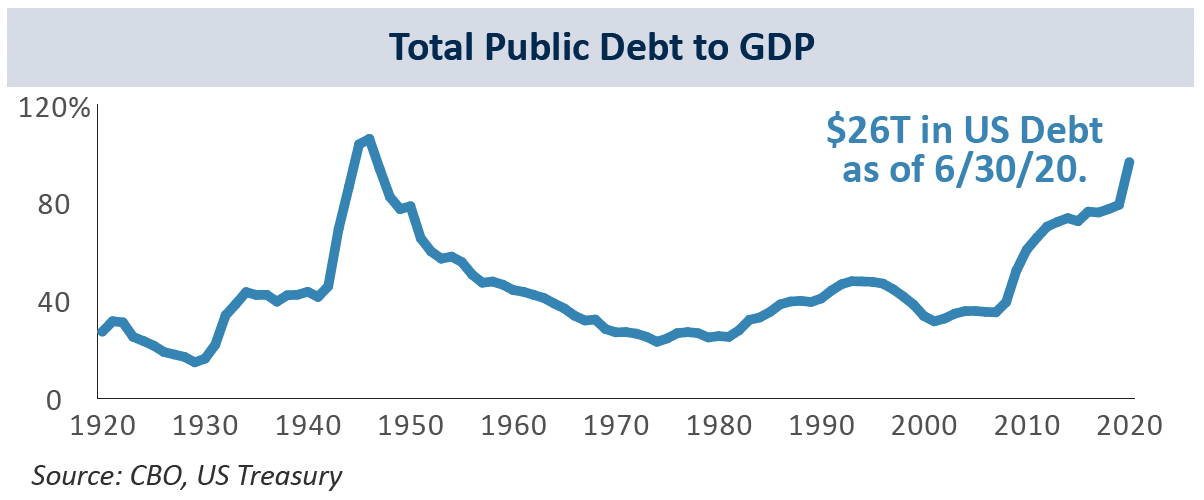

- State and local governments will need cash infusions to manage through the fiscal year without significant layoffs (their activity represents approximately 17% of US GDP). Global debt also is an issue, with developed market government debt, as a percentage of GDP, greater than that incurred during World War II.

THE ECONOMY

Confidence Is A Key Driver In The COVID-19 Impacted Economy

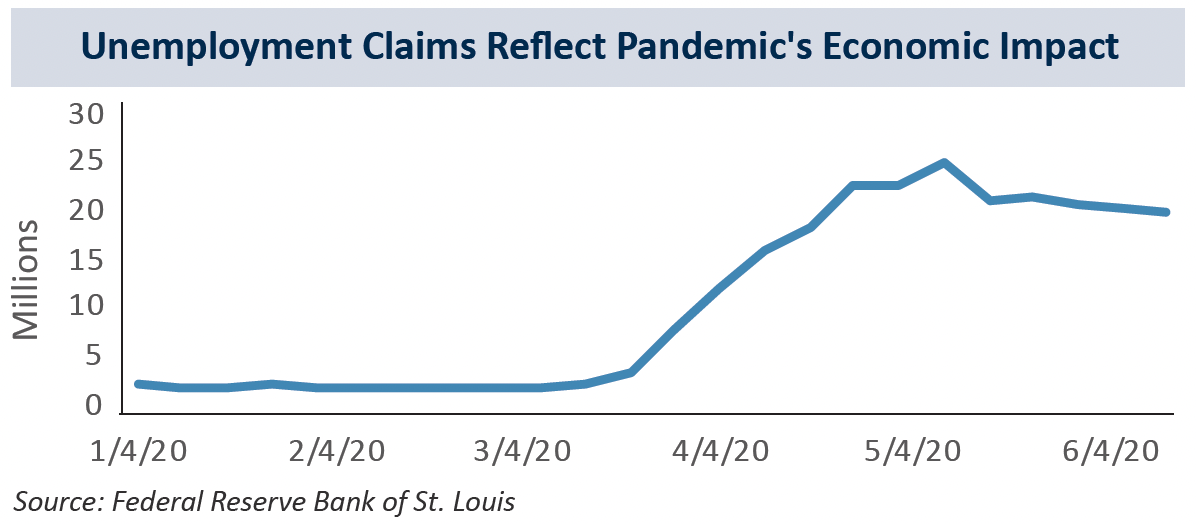

Confidence, fueled by Fed policy measures, continues to be a key driver in the consumer-driven US economy challenged by the impact of the COVID-19 pandemic and the resultant economic shutdown. Businesses across the country have experienced an unprecedented decline in demand, while the historically high level of unemployment has made life difficult for many Americans. Almost 20 million Americans currently receive continuing unemployment benefits every week, according to the US Labor Department. Before this year, the highest number of Americans receiving unemployment benefits in a single week was 6.6 million in 2009, according to Labor Department records that go back to 1967.

As businesses gradually reopen across the country, many of these former employees will be rehired. However, we expect that elevated levels of layoffs and higher unemployment will remain the norm in 2020 as many businesses permanently close. Accordingly, the Fed predicts a slow recovery with an unemployment rate of 9.3% by the end of 2020.

While Fed Chair Jerome Powell said the labor market may have “hit bottom” after recording a 14.7% unemployment rate in April, we believe it is too soon to know for certain. Going forward, unemployment claims data will tell the story, dependent on the virus path and any changes to consumer behavior coming out of the virus lockdown.

“This is the biggest economic shock, in the US and the world,

really, in living memory. We went from the lowest level

of unemployment in 50 years to the highest level in close

to 90 years, and we did it in two months.”-Fed Chair Powell

As businesses reopen and adjust to operating in this “new normal”, the timing of unemployed Americans returning to work is critical. The extra $600 per week in unemployment benefits that Congress approved in March expires July 31st, and many small businesses likely will exhaust any Paycheck Protection Program funds during the summer months.

Fed Stimulus Continues To Buoy All Markets

The Fed’s massive policy response to the economic impact of COVID-19 continues to buoy all markets and has reassured both US and global investors that any and all actions will be taken. The goal of the Fed, and Congress with the CARES Act, has been to mitigate the immediate financial impact of COVID-19 as a challenging one-time episode, rather than a multi-year or decade-long event. The fact that the Fed, Treasury and Congress responded quickly with such a significant depth and breadth of stimulus should lessen the risk of this pandemic period turning into a 1930s-like economic depression.

Consumer confidence has been bolstered by the perception that the Fed will proactively implement various monetary policy tools to support the economy for as long as necessary. The Fed’s credibility as a guiding institution is powerful, and the US equity and fixed income markets have responded positively. While Congress’s CARES Act also was helpful to a degree, the boost to consumers from payments in April and May has faded, and we expect Congress to approve another round of fiscal support this summer. Despite the significant level of monetary and fiscal policy stimulus, we don’t expect inflation to be a near-term concern in the current demand-shocked, deflationary environment.

Government Debt Is At Historic Levels

Government interventions to mitigate the economic impact of COVID-19 have resulted in developed market government debt greater than that incurred during World War II, as a percentage of GDP. The long-term impact of this growing government debt on global economic growth remains to be seen. From a policy perspective, countries around the globe are much more concerned today with stemming the near-term health and economic impacts of COVID-19.

At a US state and local government level, we believe an additional cash infusion will be needed from Congress to manage through the next fiscal year (for most states starting July 1st, 2020) without significant municipal layoffs and budget cuts as tax revenues decline. Congress already has provided $275 billion in aid to states, and we expect an additional $250 billion will be forthcoming.

State and local government activity is an important economic driver and represents approximately 17% of US GDP. While demands on state and local services have increased, corresponding state tax revenues have fallen dramatically. Approximately two-thirds of state revenues come from income or sales taxes that have been significantly impacted by the rise in unemployment and business closures. Most states are legally bound to balance their budgets, so any shortfalls in tax revenues, without additional fiscal support from Congress, will result in significant cuts in public services pertaining to education, health, and other social programs, or tax increases.

EQUITIES

There Is No Alternative To Equities For Long-Term Growth

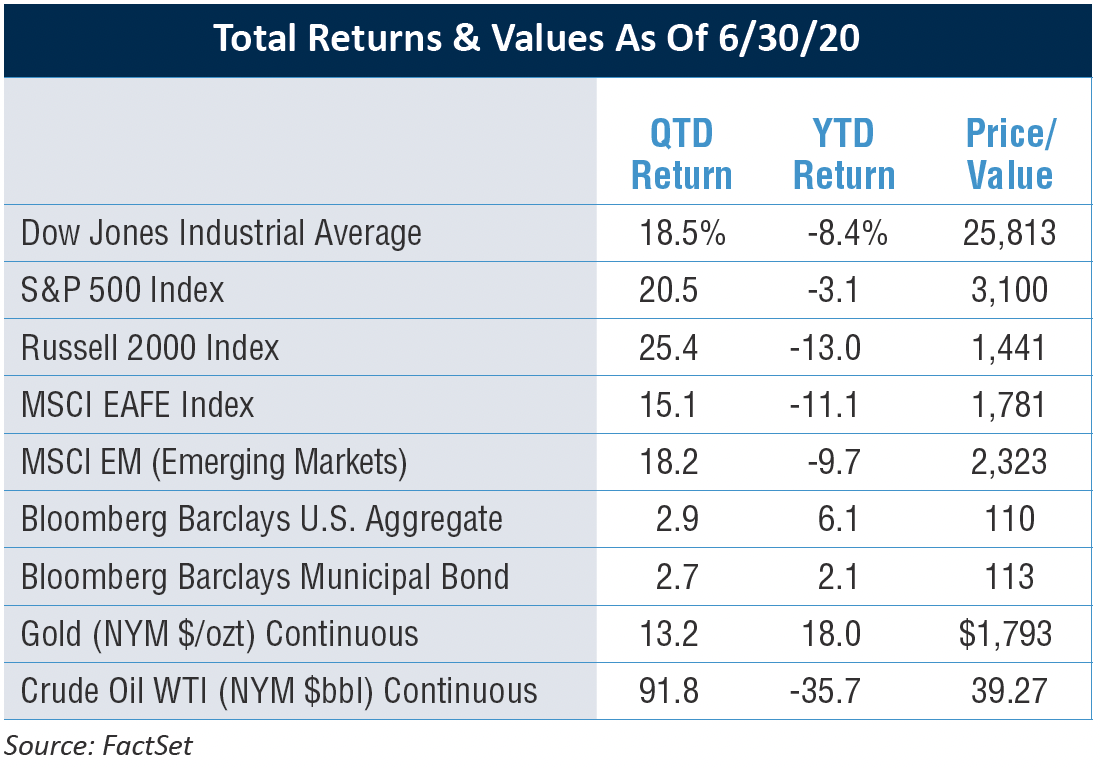

After the fastest 30% decline in history, the equity markets showed surprising resilience and rebounded quickly. Despite heightened volatility during March and April, they were buoyed by bold Fed actions and government stimulus programs that raised investor confidence levels. As a result, investor sentiment was not impacted to a level commensurate with the health and economic severity of the COVID-19 crisis.

With the Fed announcing that rates will remain low for the next several years, the current interest rate environment encourages investors to continue to turn to equities for long-term growth. The acronym referring to equities, TINA (There Is No Alternative), still applies.

We Expect A Headline-Driven Ebb and Flow

Despite the pandemic and impact of the economic shutdown, equities still provide the best opportunity for growth, over a reasonable time horizon, supported by long-term earnings growth and, in most cases, stable or rising dividends. Bolstered by an array of powerful Fed actions and government stimulus, these factors have enabled the equity market to rebound significantly and swiftly from its March 23rd low. Admittedly investor confidence can be fragile and will be buffeted by future headlines on health and economic concerns, along with increasing policy uncertainty due to the upcoming US presidential election.

Betting On The Equity Market

Concurrent with the stay-at-home and work-from-home orders, a small percentage of retail investors have renewed interest in stock speculation. While we have witnessed an increase in retail stock trading (with a number of investors trading in small dollar amounts as a recreational alternative to online sports betting), it appears that this activity is miniscule relative to overall equity volumes and is not having a significant impact on the broad equity market. Interestingly, certain struggling businesses, such as Hertz and JC Penney, have been the target of some of this new activity. While this type of speculative behavior can be a warning sign of excessive enthusiasm, like the tech bubble of the late 1990s or the real estate bubble of the early 2000s, we do not believe there is sufficient breadth and depth to this betting mentality to brand it as a broad market bubble.

We do expect equity market volatility to stay elevated for an extended period of time due to the acute uncertainty driven by the health crisis and protracted economic recovery. Given extremely low interest rates and with a long-term perspective, we continue to be enthusiastic about the equity market and prospects for moderate capital growth over the long term. With that said, we believe bonds and cash equivalents can play an important role in moderating portfolio volatility and providing a more stable pool of capital to fund cash flow needs. Using rigorous research and our prudent risk management approach, we continue to invest in select high-quality companies with strong balance sheets, sustainable competitive advantages, and the potential for attractive long-term growth.

FIXED INCOME

It’s Fine, The Fed Is Here

In addition to the rebound experienced in the equity market, the corporate bond market also has been highly responsive to Fed policy measures. Actions taken by the Fed to restore credit market functioning has had the desired result. Liquidity has returned, interest rates have been reduced to support further investment and various credit facilities have stabilized corporate bond markets, even with relatively low levels of actual purchases by the Fed to date. For the most part, these steps were taken from the monetary policy playbook that was developed during the Financial Crisis of 2008 to 2009 and, thankfully, have provided the necessary support to counter liquidity issues that could arise from the pandemic.

Low Cost Debt Fuels Corporate Bond Issuance

US companies are eagerly issuing corporate debt in record amounts to shore up liquidity in order to weather the revenue impact from the pandemic and to lock in historically low borrowing costs. To put this in perspective, investment-grade companies already have issued debt in 2020 in amounts in excess of the $1.15 trillion total for 2019. The increased supply of corporate bonds has been met with strong demand by investors as they seek higher yields relative to Treasuries and remain sanguine in light of the Fed corporate credit backstop facilities.

THE INCREASED SUPPLY OF CORPORATE BONDS HAS BEEN MET WITH STRONG DEMAND BY INVESTORS.

Not Onshoring, But Navigating

While there is recent speculation that new corporate bond issuance is a source of potential funding for bringing business processes to the US, we believe that this is not the case. Since we did not see onshoring occurring years ago as a result of favorable tax reform, we believe the additional corporate cash was secured to provide the necessary financial flexibility to weather the coronavirus storm. In addition, a portion of new corporate bond issuance is for refinancing higher-cost debt. Given the fact that 50% of the investment-grade market is BBB-rated, improving the refinancing ability and interest costs of those lower-rated borrowers is important during this challenging economic time.

WE CONTINUE TO OVERWEIGHT INVESTMENT GRADE CORPORATE BONDS AND EXPECT BBB EXPOSURE TO INCREASE IN PORTFOLIOS.

With the increase of BBB-rated corporate bonds and the Fed’s resolute support of the bond market and economy, we continue to overweight investment grade corporate bonds and expect BBB exposure to increase in portfolios. As the Treasury market seems to be range-bound at extremely low levels, (which means a slight increase in rates can have a negative impact on portfolios), we do not anticipate extending duration and will be fastidious in our selection of future bond purchases.

Insights On Municipals

Consistent with other fixed income sectors, municipal bond yields likewise are falling and are historically low despite mounting credit concerns. Muni ETFs and mutual funds are experiencing strong inflows after a period of record outflows. These vehicles are the beneficiary of a scarcity of individual municipal securities due to light (albeit rising) new supply. Even prior to the pandemic, municipalities were increasingly utilizing the taxable municipal market for their funding needs, and that trend remains intact. While interest rates often are higher for taxable issues, the red tape and time frame required to qualify for the tax exemption is avoided, resulting in faster access to the market.

As a result, there is not a sufficient supply of traditional tax-free municipal bonds to offset what is maturing during the peak June/July reinvestment cycle. Given that tax-free yields are attractive relative to taxable alternatives, since generally they benefit less directly from Fed buying, money is pouring into the market. Assuming credit concerns are mitigated by additional stimulus dollars, we expect solid demand moving forward, although selling related to the July 15th tax deadline could offset this trend somewhat.

Keeping An Eye On Credit Quality

Deteriorating credit quality resulting from declining tax revenues, higher unemployment and growing costs associated with the COVID-19 pandemic will be an issue to watch for many municipalities and other sectors of the market. The healthcare sector in particular has been hurt financially while dealing with the pandemic. However, many hospitals that are not at full COVID-19 patient capacity are resuming profitable elective procedures which will help repair the credit quality of these institutions. Conversely, we believe the credit quality of nursing homes will remain under pressure and will not fully recover until an effective treatment for the virus is developed.

Another large sector within the municipal market impacted by the economic shutdown includes toll roads. Higher unemployment combined with shifting behaviors among those still employed but working from home are negatively impacting usage, which is a headwind for toll revenue. Within the higher education space, dormitory bonds likewise are under pressure due to uncertainties surrounding college attendance in the fall of 2020.

As a result, we are focusing our purchases on high-quality state and local government issuers who are allowed to tap the Fed for liquidity, as well as water, sewer, and other essential service issuers whose revenues should fare better post-pandemic. Consistent with our long-standing philosophy, we remain committed to a defensive posture in the municipal bond space, investing solely in higher-quality issuers that we believe are best positioned to navigate this challenging time.

WHAT WE THINK

The impact of COVID-19 continues to be far reaching across the domestic and global landscape. Many lives have been changed irrevocably over the past several months, and many businesses are facing challenges never anticipated. A safe, effective, and proven vaccine will be both a health and economic game changer. It must be remembered that there is no modern playbook for the pandemic, the impact of which will be exacerbated by a potential second wave.

WE BELIEVE HIGH-QUALITY EQUITIES STILL PROVIDE THE BEST OPPORTUNITY FOR GROWTH OVER THE LONG TERM.

Ultimately, we anticipate a “square root” economic recovery. This includes the combination of an economic bounce-back from the initial shutdown followed by a plateau in the predominantly service-based US economy. In this scenario, we expect lower demand and higher persistent unemployment levels, particularly in retail, travel, leisure, and other consumer-facing industries. Compounding significant issues associated with a recovery, the November elections and corresponding political rhetoric likely will add headline risk and policy uncertainty during this already challenging economic period.

From an investment perspective, we believe high-quality equities still provide the best opportunity for growth over the long term while bonds and cash equivalents continue to play an important role in mitigating portfolio volatility and funding cash flow needs. We favor investment grade corporate bonds but without extending duration. For municipal bond investments, we will focus on high-quality state and local government issuers, including essential service issuers whose revenues should fare better post-pandemic.

As we monitor the evolving situation, our steadfast commitment to helping you meet your investment goals through effective portfolio management remains unchanged. We are here to serve as your trusted advisor and appreciate your continued confidence in 1919 Investment Counsel as we navigate this challenging and unprecedented time.

The views expressed are subject to change. Any data cited herein have been obtained from sources believed to be reliable. The accuracy and completeness of data cannot be guaranteed.

Past performance is no guarantee of future results.