Weekly Market Insights 01.29.24

All Eyes on the Fed!

Financial Markets

Financial markets continued on a positive trajectory this past week, with equities again reaching new all-time highs. The Dow increased by 0.65%, the S&P 500 by 1.06%, and the NASDAQ by 0.94%. Investor confidence is centered on expectations that the Fed will cut rates this year, potentially as early as March. They will be waiting anxiously for Wednesday when the Fed concludes their rate decision meeting, and Chairman Powell hosts his post-meeting press conference. Interestingly, recent market behavior suggests that the investment community appears to be finding reasons to be happy with both good and bad economic news.

Economics

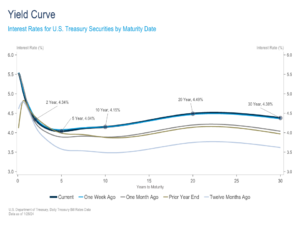

We wrote above that investors appear to be happy with both good and bad economic news. If investors are looking for more rate cuts, then good news, somewhat perversely, is any news suggesting that economic growth is slowing. However, as stocks were reaching record highs this past week, 4th quarter GDP growth came in at 3.3%, significantly higher than the projected 1.8%. If investors were expecting the Open Market Committee to cut rates sooner rather than later, this was not an inspiring report. There are other economic signs that the United States economy is far from falling out of bed. The labor market remains strong by most measures, consumer spending is fine, and, as we reported last week, consumer expectations about the economy are improving. None of this is necessarily a harbinger of high inflation, but it is hardly a signal that we should expect an immediate drop in rates. This is not an argument that the Fed will not cut rates but that time is on their side, so they may opt to wait and see.

Our opinion about the prospects for foreign markets relative to the United States has been in favor of the U.S. We have not changed our opinion, but things are looking better for some other markets around the world. We remain, as many other investors, skeptical on China. The U.K.’s economy remains weak and will probably remain that way until the country can settle its political turmoil. The good news is the European Union appears to be gaining headway. This should not be particularly surprising. While the E.U. has been trailing the U.S., and weakness in exports to China are a drag on their economy, it has been progressing nonetheless.

Conclusion

The United States economy has been and remains the driving force of the global economic engine. We are encouraged by the European Union’s progress of late. China remains in a difficult position both economically and politically, with each of these areas feeding on the other. There are signs that emerging market countries are beginning to feel the effects of increased global liquidity. Interestingly, there has been a pick-up in conversation about the BRICS de-dollarization efforts. Our opinion remains the same. The effort is doomed to failure, particularly since the progenitor, China, is having such a difficult time. The United States financial markets remain the preferred home for U.S. investors.

Read pdf here.