Women & Wealth: Planning Challenges and Opportunities

When it comes to planning for their futures, women face distinct challenges.

On average, women in the U.S. live longer and have higher health care costs than men. At the same time, women tend to earn less, under-invest, accumulate less, and incur more debt over the course of their lives. Women often face the daunting task of caring for loved ones at the expense of their own energy and resources.

In a century of working with individuals and families, we have seen the impact these challenges have on an individual’s future – and the unique opportunities they provide:

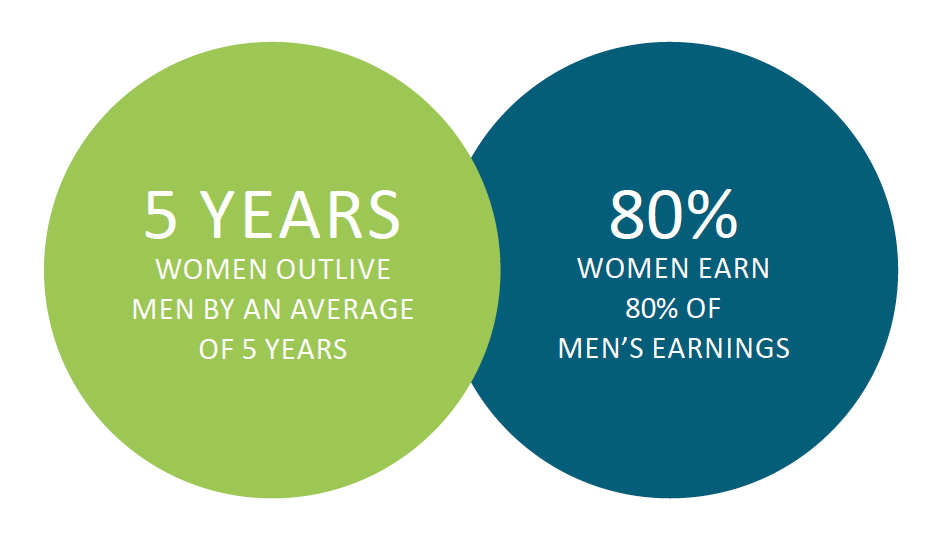

- Women outlive men by an average of 5 years,1 and must be prepared to make their wealth last over a longer period of time.

- Women earn 80 cents for every dollar a man earns,2 and need to maximize every opportunity to build wealth during their working years.

- Women have financial literacy rates that are roughly 50% those of men,3 and have to overcome a knowledge gap in order to protect and grow their wealth.

- Women have 25% less in retirement savings than men at age 65,4 reflecting a greater need to plan earlier and save more.

- Women’s health care costs average nearly 25% higher than those of men,5 and need a savings and investment approach that accounts for accelerated costs.

- Women represent between 60%-80% of caregivers,6 and not only need to save more to cover the costs of care, but also be prepared for the increased mental and physical toll.

- Women who are single give more to charitable causes and in higher amounts than men,7 and thus need to maximize the philanthropic impact and tax benefits of their gifts.

These issues are complex and interconnected, and together contribute to the startling “wealth deficit” women of all backgrounds, education levels, and vocations encounter throughout their lives. We highlight ways to address these challenges through a combination of planning, education, and thoughtful decision-making—paving the way for greater financial stability, flexibility, and freedom.

7 KEY PLANNING OPPORTUNITIES

We have identified the following seven key planning opportunities with proactive steps in addressing the challenges that women face.

challenge #1

Women Outlive Men

Women currently outlive men by an average of 5 years, with U.S. female life expectancy at 81.1 years compared to men at 76.1 years.8 In addition, women are 54% more likely than men to live to age 90.9

Living longer means more years to fund living expenses, which in turn puts pressure on your portfolio to generate strong returns for a longer duration. For any individual factoring in longevity, it is vital to address the higher likelihood of outliving one’s assets and make appropriate adjustments in the planning process.

Without considering the reality of longevity, women – or anyone facing a longer time horizon – are at risk of misallocating investments and trading long-term growth in favor of short-term stability.

In fact, a recent study of high-net worth investors revealed a difference between how women and men reacted following market volatility. During the second half of 2018, only 17% of women reported that they purchased new investments while the market was down, compared to 24% of high-net worth men in the study.10 If this pattern holds true and women are less likely to act on market pullbacks as investment opportunities,11 it can lead to unintended but damaging financial consequences over many decades.

the opportunity

Plan Upfront for a Longer Time Horizon

The simplest and most straightforward way to address this issue is to start investing for retirement and longevity early and in a disciplined manner. This unlocks the benefits of compounding growth, which is key to long-term wealth accumulation. The effect of compounding growth is even more powerful when accumulated over decades in a tax-deferred or tax-free account.

Retirement accounts: Retirement accounts including Traditional and Roth Individual Retirement Accounts (IRAs) and employer-sponsored plans (i.e. 401(k) plans) are powerful tools in building wealth for those with earned income. They are tax-advantaged, and allow investments to grow while deferring capital gains taxes until they are taken out of the accounts. The earlier you fund the accounts, the better, even with small dollar amounts. Starting with small, steady contributions can have a tremendous impact on the ultimate outcome. There are rules around contributions and distributions for retirement accounts, including income limits. A full understanding of your tax situation is critical in using these tools effectively.

Taxable Investments: Outside of retirement plans, you can invest in a regular taxable account, sometimes called a brokerage account. The key is to identify the asset allocation mix that is appropriate to your time horizon and objectives, and then to stay invested, adding to the accounts regularly. It can be as simple as setting a reminder to invest extra cash on a regular basis (once a month, or once a quarter, for example), or even better, automating the process.

Risk Tolerance: Assessing risk tolerance accurately can be difficult, but is important to arriving at the right asset allocation. This determines how to best position investments to grow over a finite period. If discomfort with short-term market volatility drives long-term investment decisions, you risk jeopardizing the ability to reach important long-term goals. At the same time, if you are invested too aggressively for your risk tolerance, you may end up derailing the investment plan when there is market pullback. The right asset allocation incorporates time horizon, risk tolerance, and short-term cash needs, and should be reviewed regularly.

Coupled with the likelihood of a longer life span, there is an urgency and need to ensure that you understand your true risk appetite in the context of investment goals, and that a thoughtful investment plan is in place to meet those goals within the appropriate risk parameters.

We recommend working with experienced advisors on a comprehensive financial plan to arrive at your investment goals and a strategy for how to achieve them.

challenge #2

Women Earn Less than Men

Women earn 80 cents for every dollar a man earns,12 despite earning over half of the bachelor’s degrees in the U.S. In fact, women with advanced degrees experience a greater pay gap as measured by gender compared with women with high school degrees.13

Women generally start at rough salary parity with men, but lag in earnings power further along in their careers.

In addition to earning lower wages, women are more likely to advance more slowly and face more interruptions in their careers. For every one hundred men promoted to manager, only seventy-nine women achieve the same level,14 a gap that continues to widen at higher levels of seniority.

Women are more likely to experience prolonged interruptions in their careers; 39% of women report taking a significant amount of time off from working, compared to only 24% of men, to care for children or other family members.15 Women are also more likely to work part time, comprising 64% of part-time workers in 2015.16 More drastically, 27% of women quit their jobs altogether, compared to 10% of men.

The financial consequences of taking time out of the labor force are severe. For women who took one year off between 2001 and 2015, their annual earnings were 39% lower than women who worked all 15 years.17

the opportunity

Save Earlier and Prepare for Career Interruptions

These realities affect financial security and independence for women to a greater degree. Even if you are at the peak of your career, you should consider the increased odds of underemployment, career interruption, and lower earnings.

A major opportunity exists in negotiating your salary when the opportunity arises. Typically, switching to a new job, taking on additional responsibilities at your current job, or a promotion or review are good times to ask for a raise.

Look to maximize every advantage available to you during working years. If a company offers a retirement plan with matching contributions, participate early and aim to maximize your contributions consistently over time and ensure you select investments according to your time horizon and risk tolerance. This will mitigate the risks of a savings shortfall if you experience career interruption.

In addition, if retirement plans lack Roth 401(k) contribution options or after-tax contributions, the plans can be amended to add such features if employees ask. Do not overlook non-monetary benefits such as generous maternity and family leave policies.

Finally, these career challenges make it even more important to consider asset allocation, and ensure a cash cushion for emergencies and periods of un- or underemployment. Having access to cash can also help ensure your long-term investment plan remains on track and invested for growth regardless of disruptions. Staying invested according to plan is key to ensuring that career disruptions do not compromise funding your own retirement and financial independence.

challenge #3

Women Face Lower Rates of Financial Literacy

In a recent study of divorced and widowed women, 74% reported that they do not consider themselves knowledgeable about investing.18

For various reasons, women may find themselves more financially dependent. The greater the dependency, the greater the exposure to loss of income or support. Lack of access to education around financial matters is often the first significant barrier to gaining financial independence. It creates a host of other issues that cannot be easily resolved without first addressing the underlying issue: access to good information to build a solid financial foundation.

the opportunity

Gain Knowledge, Gain Financial Independence

Some practical steps include ensuring estate planning documents are current, obtaining a prenuptial agreement, and securing life and disability insurance for the higher earner to protect the more financially dependent partner.

Focus your preparation in two ways:

Personal Balance Sheet: Create a personal balance sheet that provides an inventory of your assets, liabilities, and ownership. This may include investment accounts, savings accounts, brokerage accounts, life insurance policies, health savings accounts, equity in partnerships or business interests, property/real estate, and even credit card reward points. Laying out your assets and liabilities on paper can prompt important conversations between long-term partners, and serve as the catalyst to address future scenarios so you can better prepare for the future.

Benefits: Understand all the benefits available to you. For example, if you are divorced, you may still have access to spousal Social Security benefits based on your ex-spouse’s benefits (given certain criteria are met, including the marriage lasting at least 10 years). This can make a big difference in a situation where one spouse earned significantly more than the other. The lower-earning spouse who may have taken a long career break would have a far smaller benefit than the higher earner. After a divorce, the spousal Social Security benefit could still be accessible, which has an enormous impact on the cash flow and security of the spouse with lower earning history.

On their own, these strategies might make a modest impact. However, do not underestimate the compounding positive effects of these strategies over time to drive the financial outcomes you desire.

challenge #4

Women are More Likely to Live Alone

Women are more likely to be single at some point in their lives than men, whether planned or unplanned.

A number of studies provide evidence that divorce creates a costlier economic fallout for women than for men, with a 27% decline in standard of living for women, compared to a 10% increase for men.19 When separation is due to the death of a spouse, the effect is even more severe, with widows experiencing a 37% decline in household income.20

This presents clear financial challenges, including loss of income during working years and in retirement (from Social security, for example) while costs may remain relatively unchanged or only slightly reduced after the death of a partner.

the opportunity

Protect What You Earn and What You Have

There are concrete steps to protect from or mitigate the impact of becoming single:

Life insurance policy: This basic step can protect a financially dependent survivor, in the event of the death of a spouse. It is important to ensure that the amount of the policy is appropriate, so that a family is not under- or over-insured. It is especially important to have insurance on the non-working spouse if he or she is a caregiver for others in the family, for the benefits will have to cover more than one person.

Disability insurance: This insurance can help to offset the loss of income, should you or an earner upon whom you depend become unable to work. Disability insurance is a historically under-utilized tool, leaving many exposed to the risk of income loss.

Beneficiary reviews: Ensure that your beneficiaries are correct on all accounts. Check accounts where you are the beneficiary, as well as ones where you are the owner. Check your retirement accounts, Transfer-on-Death accounts, Health Savings Accounts, Trusts, and life insurance policies to ensure that your wishes are current, especially in a second-marriage or partnership situation.

challenge #5

Women Pay More for Health Care

The availability of health care and the cost of care are major concerns in planning for women. Women spend 21% on more health care than males across all ages.

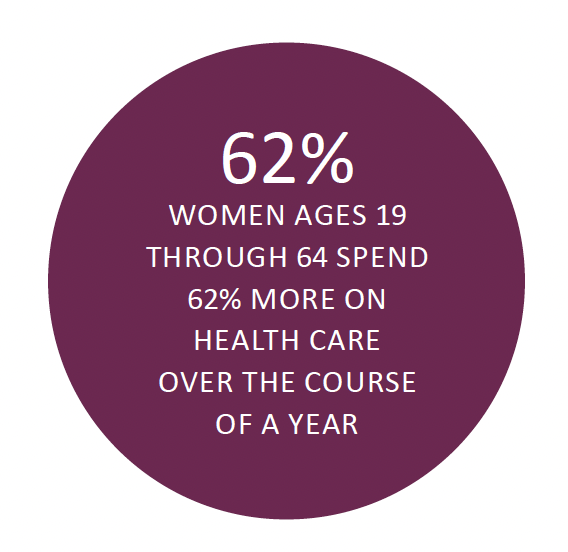

As of 2016, only 29 states had 90% or more of resident women (ages 18 – 64) covered by health insurance.21 The average health care costs for a 65 year old woman over her lifetime is approximately $235,000.22 More strikingly, for working adults ages 19 through 64, women spend 62% more per capita over the course of a year, largely due to costs associated with maternity care costs.23

Health care costs affect many financial planning factors, including future spending projections and your ability to save towards long-term investments. Higher medical costs today impede cash flow tomorrow, and make it more difficult to save and invest for retirement on a regular basis.

the opportunity

Account for Higher Costs, Explore Health Savings

Evaluate whether or not you have the right health insurance in place, and consider all options that can help you build as much of a cushion as possible for future expenses.

Health Savings Account: One option worth exploring is a Health Savings Account (HSA), which can provide a triple-tax advantage: pre-tax contributions, invested funds that grow tax-sheltered, and tax-free withdrawals for qualified medical expenses. Unlike Flexible Savings Accounts (FSAs), which must be used in a plan year, HSAs can accumulate year after year towards larger medical expenses in the future. Currently, HSAs are available to those with a high-deductible medical insurance plan. Contribution limits and other rules around FSAs and HSAs may change each year, so it is important to stay up to date.

As health care costs can snowball quickly and jeopardize financial stability, women must choose health care coverage and insurance wisely.

challenge #6

Women Are the Primary Caregivers for the Elderly

Globally, women are the predominant providers of unpaid care for family members with disabilities or chronic medical conditions. Estimates indicate between 57% and 81% of all caregivers of the elderly are women.24

This is a multi-faceted issue:

The physical and mental toll: Studies have shown that women experience greater mental and physical strain while providing care.25 This strain often manifests in personal health issues that arise after the initial caregiving phase is over, and also jeopardizes their ability to achieve their own goals.

Financial impact: Caregivers may be responsible for shouldering all or part of the financial burden of providing care. The cost of long-term caregiving can skyrocket to $8,000 per month, the national average for a private room in a nursing home.26 This is yet another contributing factor to stunted career advancement for women, who may compromise their highest earning years while providing a disproportionate amount of care. The financial aftermath of providing care may extend far beyond the years of actual caregiving.

the opportunity

Develop an Elder Care Plan

Multigenerational caregiving for elderly parents or disabled family members can cause a trifecta of financial, emotional, and physical difficulties. There is a clear need to plan for long-term care, involving both dollars and emotional impact. The more difficult the conversation, the easier to avoid or delay important decisions which will only exacerbate the situation.

Elder Care Planning: Often times, the need for care arises unexpectedly and before a plan is developed and discussed. Consider developing a care plan to document the needs and desires of the relative who may require care, key trusted contacts for emergencies, doctors’ information, medications, health conditions, and locations of relevant documents. This can be a good way to ensure key legal and estate documents are in place and updated. The documents include but are not limited to a Will, a Living Will, a Health care power of attorney, Durable financial power of attorney, HIPAA release form, and in some cases a Revocable Trust.

Understanding the potential financial impact is key to planning. For example, it is crucial to understand that long-term care expenses are not covered under health insurance, and is only covered under limited situations for a finite period of time under Medicare.

Starting the process early enough can help you get ahead of the financial and emotional challenges of caring for an elderly parent, family member, or yourself. As part of the process, you can research the states and cities that have lower costs for professional nursing care. You can also work with a Medicare consultant on optimal policies in your area, consult a reputable elder care attorney, and evaluate long-term care insurance options. Even thinking through a “worst case scenario” can open the door for productive conversations.

challenge #7

Women Lead the Way in Philanthropy

Single women are more likely to give to charity, and in greater amounts, than men.27

In recent years, giving by women has emerged as a force in the world of philanthropy. Women are also more likely to consider social responsibility and impact when making investment decisions. The challenge to overcome here is unleashing the full potential of this trend, given the other issues that may limit women’s ability to give to the fullest extent.

the opportunity

Aim for the Greatest Impact with Donated Dollars

From an investment standpoint, there are many ways to achieve a greater impact. Effective tax planning through strategic charitable giving can result in a higher net donation to the charity. Electing to donate appreciated stocks is a potential way to gift tax efficiently. There are rules associated with deductibility in giving cash versus stocks but exploring all avenues will help maximize charitable impact and tax benefits. You can also consider incorporating impact investments in the portfolio strategy.

Multiple tools are widely available for tax-efficient giving to charity. One example is a Donor-Advised Fund (DAF).

Donor-Advised Fund: As part of an overall wealth planning strategy, a Donor-Advised Fund allows donors to give a large donation in one year, and decide in future years when and how much to give to specific charities. This approach offers an immediate tax benefit to you as the donor, and can help charities over time by providing donors a way to give sustainable, regular contributions, boosting stability in donations. A DAF may work well in a situation with highly appreciated stock or another type of asset, or in a position with a large concentration.

WHAT’S NEXT

Throughout their lives, women face challenges at every turn in their careers, family situations, and health.

At 1919 Investment Counsel, we seek to listen, understand your needs, and bring clarity to complex challenges. We are committed to finding the right solutions for you, and to delivering clear, compassionate, and flexible wealth management services to help you meet your goals.

Consider a conversation with us.

LU HAN, CFA, CFP®

Lu Han is a Principal and Client Advisor at 1919 Investment Counsel. Her primary focus is financial planning for individuals and families. Lu takes a comprehensive approach to assessing all aspects of a client’s financial situation, including retirement planning, goal funding, cash flow analysis, insurance reviews, college savings, and estate planning. She partners with Portfolio Managers to identify and integrate meaningful solutions with investment management, and to interface with clients on a regular basis to provide ongoing financial planning services as a part of the firm’s wealth management services.

Lu joined the firm from UBS Financial Services Inc., where she was a Financial Planning Specialist working with financial advisors to deliver planning and advice to clients. Lu is a Certified Financial Planner®, a CFA Charterholder, and holds a B.A. in English and Psychology from Barnard College.

- OECD, “Health at a Glance 2017,” OECD Indicators, November 2017

- S. Census, “Income Poverty in the United States,” 2017. Figure is based on full-time employment.

- The American College, “2017 RICP Retirement Income Literacy Gender Difference Report,” NY Life Center for Retirement Income, 2017

- Brown, Rhee, Saad-Lessler, and Oakley, “Shortchanged in Retirement: Continuing Challenges to Women’s Financial Future,” National Institute on Retirement Security, March 2016

- S. Department of Health & Human Services, Use, expenditures, and population MEPS data, Agency of Health Care Research and Quality.

- Sharma, Chakrabarti, Grover, “Gender differences in caregiving among family – caregivers of people with mental illnesses,” World Journal of Psychiatry, March 2016

- Women’s Philanthropy Institute, “How Women and Men Give Around Retirement,” July 2018

- OECD, “Health at a Glance 2017,” OECD Indicators, November 2017

- The Hamilton Projection, “Probability of a 65-Year-Old Living to a Given Age, by Sex and ”

- Oppenheimer Funds, The Generations Project Study, Women Wealth & Families

- Investment decisions should be made based on each individual’s goals and investment plan, and there are likely to be valid reasons for some of these

- S. Census, “Income Poverty in the United States,” 2017. Figure is based on full-time employment.

- Gould and Kroeger, “Women can’t educate their way out of the gender wage gap,” Economic Policy Institute, March 2017

- Chin, et “Closing the Gap,” McKinsey & Co., September 2018, pg. 3 – 8.

- Graf, Brown, and Patten, “The narrowing but persistent gender gap in pay”, The Pew Research Center, March 2019

- TIAA Institute, “Financial Capability and Financial Literacy among Working Women: New ” Research Dialog Issue no. 129, March 2017

- Rose and Hartmann, “Still a Man’s Labor Market: The Slowly Narrowing Gender Wage Gap,” Institute for Women’s Policy Research, November

- 2018 UBS Study on divorced and widowed women

- Peterson, R. (1996). A re-evaluation of the economic consequences of divorce. American Sociological Review, 61, 528–536.

- Elizabeth Olson, “New Widows Have Another Concern: Their Finances,” The New York Times, September 4,

- Status of Women in the States, Fact Sheet, IWPR #R532, March 2018

- HealthView Services

- Centers for Medicare and Medicaid Services, “Health Expenditures by Age and Gender – Highlights ” CMS.gov

- Sharma, Chakrabarti, Grover, “Gender differences in caregiving among family – caregivers of people with mental illnesses,” World Journal of Psychiatry, March 2016

- Sharma, Chakrabarti, Grover, “Gender differences in caregiving among family – caregivers of people with mental illnesses,” World Journal of Psychiatry, March 2016

- Genworth 2017 Cost of Care Survey

- Women’s Philanthropy Institute, “Do Women Give More? Findings from three unique data sets on charitable giving,” September 2015