Savings are Down, Credit Card Balances Are Up—and that Isn’t Good

October 6, 2025

Financial Markets

U.S. financial markets continued to climb last week, with equities extending gains despite a swirl of negative headlines. Political gridlock in Washington, persistent budget uncertainty, and mounting global instability have done little to derail investor optimism. Investors appear focused instead on the prospect of additional rate cuts, even as the underlying data tell a more complicated story.

The resilience of equities in this environment reflects both strong corporate earnings and investor psychology—specifically, the ongoing “fear of missing out.” Yet this momentum exists alongside growing unease about the broader economic backdrop. With monetary policy still tight and consumer finances weakening, the disconnect between market performance and underlying fundamentals has widened. Investors may soon confront the reality that the same forces lifting markets could also magnify future volatility.

| Index | Prior Week | Year-to-Date | 1-Year |

|---|---|---|---|

| S&P 500 | 1.11% | 15.32% | 19.38% |

| S&P 500 Equal Weighted | 1.42% | 10.78% | 9.94% |

| Dow Jones Industrial Avg. | 1.11% | 11.34% | 13.21% |

| NASDAQ Composite | 1.33% | 18.57% | 27.99% |

Political uncertainty remains a key risk. The continuing budget stalemate and tariff confusion have weighed on sentiment in fixed income and currency markets, while the administration’s unpredictable policy posture has amplified short-term swings.

Economics

Economists often divide their analyses into two broad categories—real and monetary. Both dimensions are crucial, but this cycle has been dominated by politics. From fiscal debates to trade tensions, economic fundamentals have increasingly been shaped by political outcomes rather than traditional business cycles.

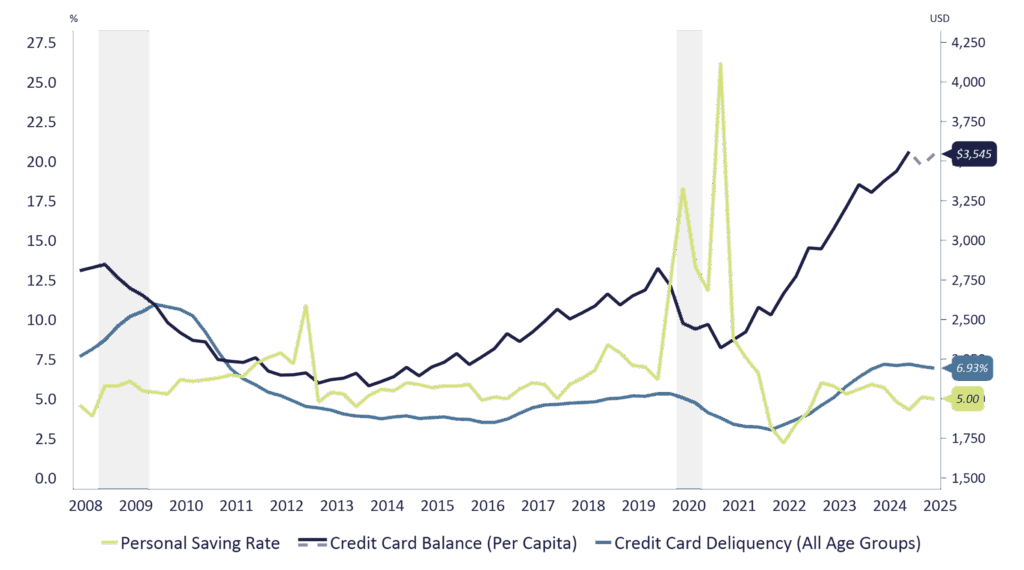

Two of the clearest indicators of economic strength are earnings and job creation—one measures spending power, the other replenishes it. Both have softened in recent months. While corporate profits have remained positive overall, wage growth has slowed, and job creation has cooled. More troublingly, the Federal Reserve’s latest data show personal savings declining while credit card balances continue to climb, signaling that consumers are increasingly relying on future income to finance current spending. This trend—known as dissaving—suggests household financial health is deteriorating, a concerning development for an economy driven largely by consumption.

Meanwhile, inflation remains sticky. The Fed’s preferred measures of inflation, PCE and Core PCE Deflators, continue to hover near 3%, well above the 2% target, complicating the path toward lower rates. While the Fed is widely expected to ease policy again this month, officials remain cautious, aware that cutting too quickly could reignite inflationary pressures.

Not all the data are discouraging. GDP growth continues at a modest but positive pace, and the U.S. labor market, though cooling, remains relatively resilient. Corporate earnings have generally held up, helped by proactive cost management and steady demand, but the rate of earnings growth is decelerating. Some companies appear to have anticipated the economic slowdown, trimming hiring or drawing down earlier inventories of lower-cost goods to preserve margins.

Consumers, for their part, have so far kept spending. Credit card delinquencies have risen slightly but remain manageable, indicating households are stretched but not yet breaking. If inflation continues to moderate and labor conditions remain stable, the economy may avoid a sharper downturn.

Still, confusion in government policy—from the ongoing budget impasse to the uncertain direction of tariffs—continues to haunt markets and consumers alike. The ongoing government shutdown has already delayed the release of key economic data, including payrolls and jobless claims. If the shutdown persists, these gaps in information could complicate the Federal Reserve’s job enormously, forcing policymakers to make critical decisions with incomplete visibility into current economic conditions. Political noise has become an economic variable in its own right.

U.S. Credit Card Balances & Delinquency Rates

Recessions indicated by shaded area

Source: Federal Reserve Bank of New York, United States, Household Debt & Credit Report (Quarterly)

Quarterly data available from 2000 to 2025, last released on Tuesday, August 5, 2025

Conclusion

It is tempting to label the current environment as “doom and gloom,” but that would miss an important nuance. GDP is still expanding, markets are setting new highs, and innovation—particularly in artificial intelligence and biotechnology—is spurring optimism about a potential new growth cycle reminiscent of the 1990s tech revolution.

That said, this optimism must be tempered with prudence. The combination of rising consumer debt, political dysfunction, and elevated inflation presents a fragile backdrop for markets priced near perfection.

Investors should remain disciplined and invested, but within their comfort zone. Maintaining diversification, quality exposure, and liquidity remains the most effective approach in navigating the uncertainty ahead.

I. Front End Disclosure

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. No part of this material may be reproduced in any form, or referred to in any other publication, without the express written permission of 1919 Investment Counsel, LLC (“1919”). This material contains statements of opinion and belief. Any views expressed herein are those of 1919 as of the date indicated, are based on information available to 1919 as of such date, and are subject to change, without notice, based on market and other conditions. There is no guarantee that the trends discussed herein will continue, or that forward-looking statements and forecasts will materialize.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all clients and each client should consider their ability to invest for the long term, especially during periods of downturn in the market. No representation is being made that any account, product, or strategy will or is likely to achieve profits, losses, or results similar to those shown.

All investments carry a degree of risk and there is no guarantee that investment objectives will be achieved.

This material has not been reviewed or endorsed by regulatory agencies. Third party information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

There is no guarantee that employees named herein will remain employed by 1919 for the duration of any investment advisory services arrangement.

1919 Investment Counsel, LLC is a registered investment advisor with the U.S. Securities and Exchange Commission. 1919 Investment Counsel, LLC, a subsidiary of Stifel Financial Corp., is a trademark in the United States. 1919 Investment Counsel, LLC, One South Street, Suite 2500, Baltimore, MD 21202. ©2025, 1919 Investment Counsel, LLC. MM-00002052

II. Investment Analysis

The information shown herein is for illustrative purposes. 1919 may consider additional factors not listed here or consider some, but not all, of the factors listed here as appropriate for the strategy’s objectives.

There is no guarantee that desired objectives will be achieved. 1919 has a reasonable belief that any third party information used for investment analyses purposes is reliable but does not represent to the complete accuracy of such information by any third party.

III. Portfolio Composition

For illustrative purposes. There is no guarantee that the portfolio composition for the strategy discussed herein will be comparable to the portfolio shown here.