Weekly Market Insights 09.25.23

A Confused Market

Financial Markets

By any measure, it has been a difficult three weeks for investors. It culminated this past week with all three major indexes being buffeted. The Dow fell by 1.89%, the S&P 500 by 2.93%, and the tech-heavy NASDAQ by 3.62%. A difficult week indeed. Of course, this did not happen in a vacuum. Analysts all have good ideas that help to explain the decline, the most simplistic being seasonal trends, with September historically tending to be a bad month for equities. The more complex issue weighing on markets has been the Federal Reserve and the fear that overly restrictive monetary policy may drive the economy into a recession. Most explanations have some degree of merit, and that may be the problem—confusion and doubt. As we will see in the economics section, the signals are not clear-cut, and Chairman Powell and his committee have not been particularly consistent in their views regarding economic indicators. Adding to investor concern is an underlying uneasiness about the political fighting in Washington and another battle over a short-term spending bill.

Economics

The culprit driving this confusion and doubt, as we all know, has been inflation. Some will argue it has been the unexpected strength of the economy, but no one objects to a strong economy. What they do object to is the byproduct of economic growth—inflation. Economic indicators are sending mixed signals, which we wrote about in greater detail last week discussing economic cycles and how this one is unique. An interesting sidebar is, while politicians are rightly speaking out about inflation, President Biden and former President Trump are both rushing to join the picket lines for the UAW. Of course, this is purely politics and says nothing of their views on inflation.

Rising oil prices have also contributed to growing concerns over inflation. There are many reasons why energy prices have increased. Certainly, the war in Ukraine is a major one. The price can be easily manipulated by large producers such as Russia and Saudi Arabia, and there is not much the United States can do about it. The U.S. has its own abundant supplies of oil and gas, but there is considerable political opposition to new drilling, and there are very long lead times between starting an oil well and when it begins producing.

Three important sources of price stability or instability are the rate of consumer spending, employment, and wages. Of course, all three of these factors are closely related. Apropos to the above, labor economists are facing an interesting conundrum related to inflation—the labor participation rate.[i] The labor participation rate in the United States has been falling for years and is currently quite low. This is surprising when wages are rising and employers are short on workers. Generally, the rate falls as the economy heads into a recession and rises coming out. However, the chart below shows this has not been the case for some time. The combination of a strong demand for workers and a low labor participation rate is a driver of inflation that is hard to address. It is quite possible that the labor force participation rate is in the midst of a rebound, as readers can see on the chart below.

Two other factors contributing to inflationary pressures have been supply chains and trade. Everyone has written about them, and, at least one, supply chains, is coming back at a reasonable rate. Trade has been slower in returning to its past highs, in part due to China, which is a political problem and the outcome is hard, if not impossible, to predict.

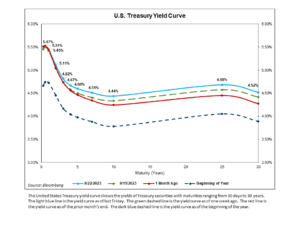

Yield Curve Update

The Treasury yield curve experienced a notable shift upward and became slightly less inverted this past week. Yields in the long end of the curve rose more than yields in the front end, driving the change. Relative to one month ago, this movement has been even more pronounced, evidenced on the chart below. As we’ve reminded readers before, there are countless reasons why the shape of the yield curve changes. This week, Federal Reserve monetary policy was undoubtedly the driving factor.

The Federal Reserve concluded their latest FOMC meeting on Wednesday, voting to hold interest rates steady at a 22-year high. While this decision was widely anticipated, the Fed committee also released their summary of economic projections (SEP) which offers insights on each participant’s assessment of the appropriate path for monetary policy given their respective economic outlooks. Not only did the SEP reveal a continued divide over whether they should raise rates once more in 2023, but it also indicated that they expect to keep rates higher through 2024 than they did earlier this year. The higher for longer message was driven by the committee’s improved forecasts for economic growth, lower expectations for inflation, and a less significant rise in unemployment. While these forecasts are indicative of a soft-landing outcome, fears that an overheating economy could lead to another bout of inflation, additional rate increases, and an eventual policy mistake are what drove longer-dated yields higher.

Conclusion

Clearly, balancing inflation and economic growth has been a difficult and perplexing task. The problem, as we are all aware, is returning inflation to 2% with as little damage as possible. The Fed is on the right track—leave the sledge hammer home! It is much better to take more time and create less chaos. No one can predict with any certainty when the mission will be accomplished. As it stands now, inflation is slowing, and, as companies report earnings, they are not predicting disaster.

We are going to end with a piece of good news. All investors and indeed all citizens have been reading from time to time about an impending financial crisis in the Social Security Trust Fund. Interestingly, there is a bipartisan proposal sponsored by Bill Cassidy, Republican senator from Louisiana, and Angus King, Independent senator from Maine that is actually gaining traction. We’re not sure which is better—someone is actually working on a solution to the problem or positive signs of a bipartisan effort.

Read pdf here.

[i] The labor force participation rate is the percentage of the civilian non-institutional population 16 years and older that is working or actively looking for work.