Weekly Market Insights 10.16.23

A Confusing World

Financial Markets

Equity markets could not maintain their early week gains. No one can blame market participants with a short-term outlook for taking some money off the table. The markets and the economy remain confusing, but that is often the case. The domestic political situation is, by and large, unprecedented. The Republican Party has entered the world of helter-skelter, while global conflict is out of hand. This past week’s equity returns were mixed. The Dow finished up 0.79%, the S&P 500 up 0.45%, and the NASDAQ down 0.18%. Market participants must have found it difficult to concentrate on economics with all that is going on in the world.

Economics

Despite two wars and a disruptive intra-political battle, the United States economic position appears to be moving in the right direction. The problem, of course, is that it is near impossible to separate economics from these other issues. One area that reflects future economic activity with less passionate impute is yield curve analysis. We will expand on this a bit more in the next section.

China continues to suffer economic difficulties, and their economy continues to slow. The problems China faces are both domestic and international. We have been writing about them for quite some time, and they haven’t gotten any better. The problem is that China’s woes are impacting the economies of most other countries around the world. China’s economic progress since the elevation of Deng Xiaoping in 1981 has been almost meteoric, but with the reign of President Xi, it has faced serious problems. Without writing a primer on Chinese economics, just as Deng left the restrictive economics of Mao, Xi has left the open economics of Deng. This deviation in economic philosophy has led to a serious domestic debt crisis driven by international lending, much of which is in default. This is by no means an exhaustive explanation of the condition of the Chinese economy. Rather, we are hoping to highlight that there is a very large global economy that is in trouble which will not help global growth for some time to come.

We have written about the conflict in Ukraine frequently in the past. The new Israeli-Palestinian confrontation threatens to escalate into another major conflict. All major military conflicts present dangers for the global economy, and this one is particularly bad for many reasons. It has started in a particularly inhumane fashion, the slaughter of innocents. The Arab-Israeli tensions have been going on since the creation of the State of Israel. This latest is a conflict that can easily spread given long existing fault lines, as well as the encouragement or direct support by forces who benefit from disruption, war, and chaos. Sadly, but interestingly, both conflicts – Ukraine and Gaza – have the ability to seriously restrict the availability and price of energy around the globe. For these and a number of other reasons, if allowed to escalate, these conflicts can cause great damage to the global economy.

The United States economy continues to grow, albeit at a slowing pace. Counterintuitively, slowing growth is a positive development for the U.S., where inflation is higher than desired but headed in the right direction.

Yield Curve Update

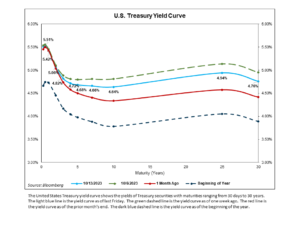

Treasury yields finished down across the board this past week, breaking a multi-week stretch where rates, particularly on the long end of the curve, surged higher. Relative to one month ago, 10-year yields have increased by around 30 basis points, while 2-year yields have risen by just 2 basis points, with the end result being a less-inverted curve. There have been a myriad of factors contributing to this push and pull dynamic, including Federal Reserve monetary policy, economic releases, Treasury supply/demand concerns, and recent comments from Fed members.

As we have noted in prior reports, the higher rate trend began following September’s Federal Open Market Committee (FOMC) meeting where the Fed’s improved forecasts for economic growth and their “higher for longer” message pressured longer-dated yields higher. Recent economic releases have largely reinforced the higher rate narrative. JOLTS data showed an unexpected jump in job openings, nonfarm payroll additions accelerated, and September’s headline CPI rose faster than expected, all combining to dampen hopes for improved labor market balance. While harder to quantify, longer-term concerns over increased Treasury issuance and escalating federal budget deficits have also contributed to the movement higher in yields. Weak demand in recent Treasury auctions has only served to amplify concerns that Treasury supply may increasingly outweigh demand going forward.

Rates saw some relief this week following dovish comments from Federal Reserve officials who noted that tighter financial conditions from higher Treasury yields may make the case for further rate hikes less urgent. The rate reprieve was also helped by a surprise-free release of September’s FOMC meeting minutes. While the committee agreed policy should remain restrictive for some time, they also agreed that the Fed is in a position to proceed carefully with the policy rate near or at its peak.

As we’ve reminded readers before, there are countless reasons why the shape of the yield curve changes, and, while it is impossible to pinpoint the cause of every movement, our hope is to highlight some of the major factors.

Conclusion

It is a very difficult economy to call at the moment, and there are many good points being made, both positive and negative. The U.S. economic outlook appears to be looking relatively positive. It is both the international and domestic political situation that is so disconcerting. We have no way to predict the outcome of either our domestic political problems or global conflict crises. These have added concerns to our view.

Read pdf here.