Weekly Market Insights 08.12.24

A Remarkable Week!

Markets

Last week’s equity market performance was remarkable, indeed. After Monday’s significant decline, markets managed to bounce back and finished the week only slightly in the red. By Friday, markets were operating as if the turbulence was over. That would be nice, but we expect that there may be more volatility to come. While the daily performance fluctuations were notable, the overall week-ending performance was unremarkable. The Dow closed down 0.60%, the S&P 500 down 0.04%, and the NASDAQ down 0.18%. Those relatively placid numbers hide one of the most volatile weeks in recent memory.

Economics

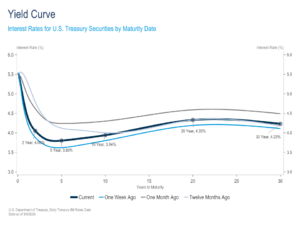

Given this past week’s market volatility, one would have been forgiven for thinking the Fed had reversed course and decided to tighten unexpectedly. Instead, quite the opposite has occurred. Markets are now pricing in, with near certainty, at least one rate cut at the Fed’s September meeting.

The economy appears to be in good shape. Specific economic indicators waver back and forth, such as jobless claims and payroll growth, but that is neither unusual nor dangerous. It only becomes an issue when the weakness persists and becomes a trend. Investors must remember that the Fed does not want a weak economy—they only want to keep growth within reason to control inflation.

It can be easy to confuse financial markets with economics. While they are certainly related, they are often misaligned. The same factors ultimately drive financial markets and the economy in the long run, but short-term motivations can distort the relationship. Economic indicators do not appear to be flashing danger, and the Fed remains on a path to easing,

The strength of the U.S. dollar, or, dollar supremacy, is a topic that comes up frequently during election campaigns. People fear that the dollar will lose its position as the world’s reserve currency and that the country will suffer as a result. In reality, dollar supremacy is in no immediate danger. The U.S. dollar became the dominant currency after the Second World War. Still, the seeds of change were planted during the First World War when England suffered from domestic financial problems, and the British colonies began to break away.

Another critical factor is that no credible challenger can take the dollar’s spot. When the European Union was formed, some felt the Euro may become a legitimate threat to the dollar. However, the E.U. has and continues to suffer from a lack of financial and political coordination, so, alas, that has not come to be. More recently, BRICS[1] made a half-hearted attempt to ascend to the top spot, but it was doomed to failure. There are two significant reasons why. 1) No one felt confident in the economies of the organization’s member countries. 2) It became apparent that China was pushing BRICS for its benefit. Today, the United States remains secure in its position as the world’s dominant currency.

Conclusion

It’s important to remember that last week’s market volatility was not in response to an economic shock. Instead, the most significant factor appears to have been a substantial unwinding of the Japanese yen carry trade. Additionally, we saw the stocks of some of the world’s largest companies correct. Due to their large weightings in the major equity indices, they had an outsized impact on the overall market decline. Of course, other factors were at play, but the impetus was from market dynamics rather than economic deterioration.

Read pdf here.

[1] BRICS is an intergovernmental organization comprising of Brazil, Russia, India, China, South Africa, Iran, Egypt, Ethiopia, and the United Arab Emirates.