Investment Review & Outlook – April 2023

Key Takeaways

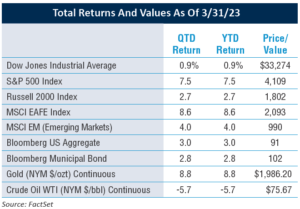

Both stocks and bonds managed to post gains for the quarter, despite a banking crisis, interest rate increases, and geopolitical concerns. This is a welcome relief following a challenging 2022 and ongoing volatility that has continued in 2023.

Both stocks and bonds managed to post gains for the quarter, despite a banking crisis, interest rate increases, and geopolitical concerns. This is a welcome relief following a challenging 2022 and ongoing volatility that has continued in 2023.- Our forecast for a mild recession late in 2023 has been pulled forward due to the banking crisis and the reduction in corporate and consumer confidence it has caused.

- A higher interest rate environment provides investors with attractive income opportunities while high-quality equities remain a driver of long-term growth in portfolios.

The Economy

The first quarter of 2023 saw the continuation of a number of significant themes, including persistent inflation, Fed tightening, both a strong job market and recession fears, and geopolitical concerns surrounding Russia, Ukraine, and China. In addition, the Fed’s rapid trajectory of interest rate hikes over the past year paved the way for the recent banking crisis surrounding Silicon Valley Bank, Signature Bank, and Silvergate Bank that caught the market by surprise in mid-March.

A few days later, US Treasury Secretary Janet Yellen worked with JPMorgan Chase CEO Jamie Dimon to organize a group of 11 banks to help First Republic Bank stay liquid following a run on its deposits. The following week, the focus shifted overseas when UBS came to the rescue to buy its troubled Swiss competitor, Credit Suisse, a venerable 167-year old institution.

Due to the speed and magnitude of rate increases over the last twelve months, it is not a surprise that something would “break.” Many banks bought long-term bonds, in most cases fairly risk-free US Treasuries and agency mortgage-backed securities, when interest rates were low. Because bond prices move inversely to interest rates, as rates rose, these longer-term securities dropped in value.

There is no guarantee that forecasts or estimates discussed herein will materialize, or that trends discussed herein will continue.

While the decline would have been temporary if held to maturity, in some instances banks were forced to sell the depreciated securities to raise cash when depositors withdrew money. In the case of Silicon Valley Bank, it was a run-of-the-mill bank run, but on steroids, fueled by social media-driven panic and a concentrated group of billion-dollar customers with uninsured deposits. At the same time, low rates on bank deposits relative to other assets, such as US Treasury bills, have resulted in depositors looking elsewhere for places to park their cash.

Investors seemed to quickly conclude that problems with banks were short- lived and the likelihood of industry contagion was minimal. It may be too soon to sound the “all clear” because the yield curve remains inverted, with short rates higher than long rates, leaving many institutions with a mismatch between assets and liabilities. Banks will start to report earnings in mid-April which should help shed some light on how they are weathering the steep surge in interest rates and the outflow from low-interest deposit accounts.

With inflation remaining elevated, in part due to low unemployment, it also would be premature to conclude that the Fed is done raising rates. In fact, the Fed’s job likely became more challenging in March as the need for tight policy to fight inflation conflicts with the need for liquidity and Fed easing should bank industry stress worsen. In addition to the dual mandate of price stability and maximum employment, it would appear the Fed, once again, has taken on the role of preventing a financial crisis. Ironically, the banking crisis that was set off, in part, by more-stringent Fed policy likely will have the added impact of reducing credit growth. This is just another path to financial tightening that serves to slow the economy and bring inflation down, thus helping the Fed accomplish its goal.

WITH INFLATION REMAINING ELEVATED, IN PART DUE TO LOW UNEMPLOYMENT, IT ALSO WOULD BE PREMATURE TO CONCLUDE THAT THE FED IS DONE RAISING RATES.

The Fed Raises Rates for the Ninth Time

Case in point, at its most recent Federal Open Market Committee (FOMC) meeting, the Fed decided to raise rates by a quarter of a percentage point, lifting the target for the federal-funds rate to 4.75% – 5% and marking the ninth increase in a year. In its FOMC meeting statement, the Fed emphasized the robustness of the US banking system but noted that the recent banking turmoil likely would result in a drag on credit availability and, thereby, the US economy. Fighting inflation remains the Fed’s priority. However, if the Fed sees clear indications of an economic slowdown, it may be prepared to pause its rate hikes, indicating the central bank’s tightening campaign might be nearing its conclusion.

INFLATIONARY PRESSURES AND HIGHER BORROWING COSTS ARE TAKING THEIR TOLL ON THE US CONSUMER, WHO REPRESENTS 70% OF ECONOMIC ACTIVITY.

Consumer Pressures Grow

Inflationary pressures and higher borrowing costs are taking their toll on the US consumer, who represents 70% of economic activity. This has been reflected in lower retail sales numbers. The banking crisis and the additional uncertainty it has introduced also may result in cautious consumer spending behavior, an important metric the Fed will consider at its next meeting in May when reviewing its monetary policy stance. An evolving consumer issue that bears watching is the depletion of “COVID savings” built up during the pandemic, and the rise of credit card balances. This development represents a potential consumer headwind if savings have been depleted before a recession even begins and while the labor market remains strong.

Rate Tightening Impacts and Unintended Consequences

We can surmise from past experience that central bank tightening cycles of this magnitude and speed often have led to some type of economic upheaval in the economy, as shown in the following chart.

Rising interest rates can lead to unintended consequences as lending costs increase. The US economic system has been awash in debt because interest rates were low for so long. Financing was inexpensive leading to consumers, businesses, and even governments taking full advantage of it. We are just beginning to see the impact of rising rates on an economy fueled, to a large extent, on this easy credit. At the same time, the Fed needs to continue hiking rates until inflation is controlled, a job complicated by the banking crisis resulting from this very same tightening policy.

Housing Sales Slow as Rates Rise

Another indication of a gradual economic slowdown from the consumer spending perspective includes housing sales. While initially housing held up better than anticipated as mortgage rates rose, buoyed by cash buyers not impacted by rising rates, the US housing market appears to be slowing. Home values have peaked, although inventory remains constrained.

Unsurprisingly, higher mortgage rates have driven some buyers to the sidelines, while many existing homeowners have decided to stay put because of their current advantageous mortgages. Approximately 85% of US homeowners with mortgages have a rate far below 6% which would be almost impossible to replace. If the housing market slows further, it will help reduce the rate of inflation.

A Tight Labor Market Continues

US businesses still are contending with a tight labor market, despite significant layoffs in the technology and communication services sectors. The unemployment rate remains low at 3.6%, and the most recent Labor Department’s JOLT Survey reported approximately 10.8 million openings, equating to 1.9 job openings per available worker. The US saw an unprecedented drop in labor participation at the onset of the COVID-19 pandemic in 2020, and millions still haven’t returned to the workforce. For companies that found it very difficult to hire qualified workers during the pandemic, they may be hesitant to lay off workers during a slowdown for fear it may be only temporary and the company will have to start the recruiting process all over again. Because the US economy is heavily consumer-driven, it will be challenging for the Fed to win the inflation battle while employment remains at a very high level with few candidates to fill new positions.

Some Perspective on the Unexpected Banking Turmoil

The banking crisis, although driven by interest rate moves and not credit problems, is having a ripple effect across the financial services industry. Banks are the lifeblood of economic activity, from individuals to small businesses to larger corporations. Because of recent turmoil, we expect bank lending standards to tighten due to greater scrutiny from lenders and regulators. This should result in a slowdown in economic growth across almost all sectors.

While substantial efforts over the years have made the largest systematically-significant banks safer and more financially sound, smaller banks have been subject to less rigorous oversight. Silicon Valley, Signature, and Silvergate Banks were niche commercial banks, very different from traditional community or regional banks. All grew deposits faster than they could grow loans prudently, while purchasing high-quality but long-term and low-yielding government securities. That proved unmanageable in a “deposit panic” or classic bank run, similar to what was so endearingly depicted in the movie, It’s A Wonderful Life.

In addition, deposit accounts at all three banks were so large that only 20% were insured by the FDIC, making them extremely sensitive to capital ratios and credit losses. Panic spread to other smaller specialty banks and those with higher percentages of uninsured deposits.

The Fed quickly designed the new “Bank Term Funding Program,” an emergency lending program created to provide liquidity to US depository institutions, which so far has calmed depositor and investor nerves. The program provides loans of up to one year to banks and other deposit institutions for the full face value of collateral securities that have temporarily dropped in value.

Trust and depositor confidence is more critical than ever, with money moving at the speed of a tweet. Bank management and regulators quickly learned this important lesson. The amount of deposits that venture capital firms pulled out of Silicon Valley Bank ($42B) in just over a day, shocked the FDIC, the Fed, and many others.

Money now moves faster than ever, and FDIC insurance coverage matters significantly, especially during times of stress. Once the deposit panic subsides and investors feel more comfortable that the crisis has passed, bank stocks should return to valuations more in line with historical levels, although it may take several quarters before earnings recover.

A Mild Recession is on the Horizon

The likely outcome of the Fed’s commitment to reducing inflation is a recession. Yet as we evaluate the economic developments we have outlined, we consider:

- The impact of the Fed’s monetary policy actions and battle with inflation.

- Consumers’ financial health in the predominantly consumer-driven US economy.

- The strong labor market as evidenced by more job openings than candidates.

- The challenges faced by US companies in an economic slowdown.

- The impact of the banking crisis on economic growth, especially given the role of banks in lending to consumers and small businesses.

Based on these factors, while we anticipate a recession, we expect it to be mild. Despite a number of headwinds, corporations (including banks), are still well positioned. Consumers, in terms of debt-to-income ratios, are in relatively good financial shape, as shown by the following chart.

The Equity Market

Volatility and Margin Pressures

It was a volatile first quarter in equities as investors had to navigate inflationary pressures, rising interest rates, geopolitical concerns and, more recently, banking system turmoil. Surprisingly, given this backdrop, the S&P 500 ended the quarter up 7.5%. In fact, as the cracks in the banking sector appeared, shares of tech companies benefitted as investors seemed to conclude that the Fed would be forced to lower interest rates. The tech-heavy Nasdaq Composite Index was up nearly 17%. There is a looming headwind for stocks as estimates for earnings decline due to slowing growth and increased margin pressures for many companies. Already, earnings revisions have been sharper than expectations, and an earnings recession is possible. At the same time, stock valuations are not inexpensive relative to historical levels.

Equities Earnings Yields Versus Fixed Income Yields

The earnings yield on equities (earnings per share/price per share) relative to bonds, as represented by the 10-year Treasury yield, is a helpful way to compare stocks and bonds. The relative yields between the two asset classes recently have narrowed as rates increased. Bond yields are key to calculating the opportunity cost of equities, as one might expect, given that equity investors would seek a higher potential return in exchange for the volatility that comes with owning stocks. For example, if the 10-year bond yields 3.5% per year (near its current level), then equities will be attractive only if they can earn well above that percentage.

While not completely predictive of future returns, there typically is a wider spread between the earnings yield of stocks and the Treasury yield. This shows that when interest rates rise, equity multiples compress, which may be a potential headwind for equity returns in 2023.

Stocks Remain a Driver of Long-Term Growth

Stocks will continue to play an important long-term growth role in a diversified portfolio. We prefer to focus on high-quality companies with superior business models, strong cash flow, the ability to defend and grow their businesses despite an economic slowdown, and are well-positioned in market segments with consistent demand because they tend to be businesses that can function in many different environments. While macroeconomic influences like inflation and interest rates can have an outsized impact on stock returns in the short run, the underlying fundamentals of high-quality companies are responsible for attractive stock returns across a reasonable time horizon. Additionally, many companies pay dividends to shareholders and tend to grow those dividends over time. The annualized growth rate of dividends in the S&P 500 has been nearly 10% over the last 5 years.

The Fixed Income Market

A Volatile Fixed Income Market

Within the taxable bond markets, higher rates created income opportunities for investors early in Q1 2023. However, volatility also found its way into the fixed-income market, with turmoil in the banking sector sparking the biggest one-day rally in short-term US government bonds since 1987. While yields initially rose earlier in the quarter, reflecting strong payroll growth and stubborn inflation trends, anxieties about bank runs and financial stability drove a flight-to-Treasuries, driving prices up and yields down.

Yields topped 4% on the 10-year Treasury in early March for the first time since last November, before yields rapidly slid after US regulators, including the Fed, announced measures to contain the fallout from Silicon Valley Bank’s sudden collapse. Investors and economists typically watch US Treasury yields because they serve as a benchmark against which all other financial assets are valued. Treasury prices rise (yields decline) when there is fear or stress in the financial markets.

Our Fixed Income Expectations

The Fed is steadfast in its efforts to lower inflation towards its 2% target. Given that they remain far from achieving this goal, we anticipate a bumpy ride in the bond market, as tight Fed policy collides head-on with investor concerns about further bank industry issues. If recessionary pressures increase, we expect corporate bond spreads to widen versus Treasuries. Wider spreads means there is a bigger difference between the lower yield of a safer bond (the Treasury), the higher yield of the riskier bond (the corporate), reflecting a worsening economic outlook and a flight-to-quality.

A Word About Municipals

The municipal bond market comes into a likely economic slowdown in great shape from a credit-quality perspective. Ratings upgrades have outpaced downgrades, and rainy-day funds are at record levels. Rainy-day funds allow states to set aside surplus revenue for use during unexpected deficits. However, if the economy goes into a recession, with slowing growth, it likely will result in credit-quality deterioration for some municipalities.

Municipal bond issuance continues to be lackluster and has not kept pace with demand for the last few years, resulting in expensive muni bonds relative to Treasuries. However, attractive opportunities should arise, especially around tax season which historically is a period of seasonal weakness for the market. Meanwhile, while the muni market remains expensive, short-term Treasuries offer a good risk/reward scenario.

OUR PERSPECTIVE LOOKING FORWARD

The rate of inflation should continue to slow as a result of monetary tightening, which should bring the Fed closer to the end of its tightening cycle. So while efforts to control inflation, along with a slowdown in banking activity, may result in a mild recession, it is important to take a longer-term perspective on the Fed’s 2% inflationary target. Lower inflation is good for financial assets, retirees on a fixed income, and many US consumers who feel the brunt of high inflation on a daily basis.

Times like these can be challenging for investors, but they also can create opportunities. Your team at 1919 Investment Counsel focuses on effectively navigating any market turmoil, mitigating risk, and evaluating attractive investment opportunities on your behalf, as they arise.

Read pdf here.

All information herein is as of March 31, 2023 unless otherwise stated. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. Past performance is not a guarantee or indicator of future results. No part of this material may be reproduced in any form, or referred to in any other publication, without the express written permission of 1919 Investment Counsel, LLC (“1919”). This material contains statements of opinion and belief. Any views expressed herein are those of 1919 as of the date indicated, are based on information available to 1919 as of such date, and are subject to change, without notice, based on market and other conditions. There is no guarantee that the trends discussed herein will continue, or that forward-looking statements and forecasts will materialize.

This material has not been reviewed or endorsed by regulatory agencies. Third party information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

1919 Investment Counsel, LLC is a registered investment advisor with the U.S. Securities and Exchange Commission. 1919 Investment Counsel, LLC, a subsidiary of Stifel Financial Corp., is a trademark in the United States. 1919 Investment Counsel, LLC, One South Street, Suite 2500, Baltimore, MD 21202.

©2023, 1919 Investment Counsel, LLC. MM-00000421