Weekly Market Insights 06.03.24

Economies Appear Strong but Markets Waver

Financial Markets

United States equity markets took a step back this past week. The Dow fell 0.98%, the S&P 500 fell 0.51%, and the NASDAQ fell 1.10%. While there was no single cause for the pullback, a slew of surprising earnings misses within the software industry weighed on the overall indices. As we have highlighted before, it’s normal for markets to pause after a sustained period of gains.

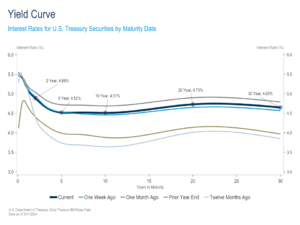

Shifting the focus to interest rates, despite ending the week essentially unchanged, yields experienced significant day-to-day volatility. Hawkish Fedspeak and Treasury supply concerns drove yields higher to start the week, with the 10-year Treasury yield climbing 13 basis points to nearly 4.64% intra-day on Wednesday. However, weaker than expected consumption data along with an in line PCE Deflator inflation report on Friday brought yields back to levels that were nearly unchanged from the week prior. Relative to the previous week, the 2-year yield declined 6 basis points to 4.89% and the 10-year yield rose 4 basis points to 4.50%.

Economics

The global developed economies, for the most part, appear to be in good shape. The largest of these economies, the United States, also happens to be the strongest and fastest growing. This, of course, is not new news, and we have written about it for some time. Outside of the U.S., we have been looking to the European Union for an acceleration in growth, and, this past week, analysts have finally begun to see growth pick up. One of the reasons the EU has suffered lower growth than the United States is Germany. Normally the industrial engine for the EU, Germany has been in a lull, in part due to depressed demand from China. Based on recent economic data, Germany appears to be back on track, and the EU is picking up steam as a result.

The United Kingdom remains in the slow growth category. The country suffers from political disarray and elections are on the way. It is difficult to make predictions until these elections are over. Both the Federal Reserve and the European Central Bank are in a difficult position, not over what to do but when to do it.

Asia is by far the most interesting case for scholars, analysts, and investors. There are four countries we are referring to. The first is Taiwan, a reasonably small country that is always under pressure from China, who claims ownership. The reason we find it so interesting is it is small, is under constant threat, and remains a capitalist poster child in the region. Taiwan is showing strong economic growth. And then there is Japan, a highly industrialized country that is seemingly making a strong comeback. The final two, China and India, are two of the earth’s largest countries in land mass, population, and economic capacity, but the similarities end there. China is a socialist country under a powerful dictator. India, on the other hand, is a diverse democracy with an elected leader and a capitalist economy. Both are battling for economic leadership in Asia. China is having economic difficulties, while India appears to be on the ascendancy. Next week, we will spend more time on these two very different but similar competitors.

Conclusion

Although the U.S. economy looks to be on solid footing, a lot of unanswered questions remain. Equity markets have made rapid advances in a relatively short period of time. For this reason, a pause may be warranted, and investors should not be surprised to see this volatility to continue.

Read pdf here.